Loans and Grants

Financial Aid

NPCollege participates in the U.S. Department of Education’s Title IV Financial Aid Programs. Applicants may qualify for tuition and other financial assistance through various public and private training or retraining agencies. These agencies include: the Veterans Administration; California Department of Rehabilitation; private rehabilitation agencies and insurance companies; the GAIN program; the State Employment Development Department (EDD); and Workforce Investment Act programs. All public and private agencies have certain requirements for eligibility.

Reimbursement to Veterans and Eligible Persons

For information or for resolution of specific payment problems, the veteran should call the Department of Veteran’s Affair nationwide toll free number at 1-800-827-1000.

What is Financial Aid?

There are several opportunities through which you can secure financial support, significantly influencing your overall expenses. Eligible forms of assistance may include:

- FEDERAL PELL GRANTS

- FEDERAL SUPPLEMENTAL EDUCATION OPPORTUNITY GRANT (FSEOG)

- FEDERAL STAFFORD LOAN

- CAL GRANTS

- PRIVATE LOANS

How to complete a FAFSA form for college?

This video will help you better understand how to complete your FAFSA application. If you feel you may still need assistance, don’t worry, you can still contact NPCollege’s Financial Aid office to help you with the process of completing your FAFSA application.

NEW APPLICANT?

Click the button below and then click on “Get Started” on the FAFSA website.

EXISTING USER?

Click this button and then click on “Access Existing Form” on the FAFSA website.

It may seem a bit daunting and complex to start your FAFSA application, but honestly, it is very simple to do if you have the necessary documents in front of you when starting the application.

If you are over the age of 24, or have dependent children, or legally married or you are an emancipated child, you will need:

-

- Social Security Number.

- Last two years tax returns.

- If you are a legal resident, you will need the Alien Registration Number “A-number.”

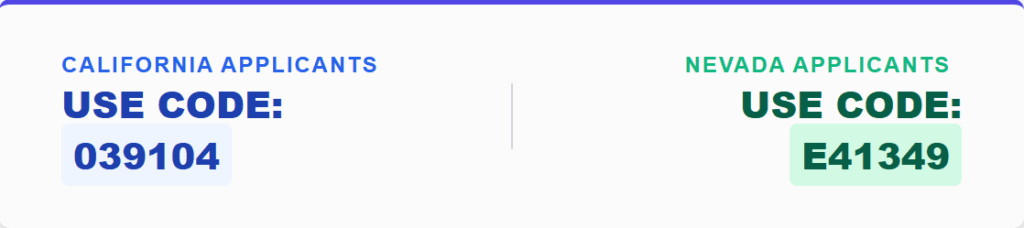

- National Polytechnic College FAFSA school code.

If you are under the age of 24, you may be considered a dependent child. In this case, you will need:

-

- Social Security number for you and your parent.

- Last two years tax returns for you and your parent.

- If either parent or you are residents, have the Alien Registration number “A-number” for you and/or your parent.

- National Polytechnic College (NPCollege) FAFSA school code.

Private Loans

If you do not qualify to apply for government-backed Financial aid grants, Subsidized or Unsubsidized loans, you may still submit an application for private lending. This is different from Financial Aid loans since eligibility for private loans is generally based on credit. However, the amount of NPCollege loans your request through College Ave® are based on credit history and the length of the program you select.

Currently. NPCollege is a certified partner to offer loans through College Ave.®

Can I apply for a private loan even if I am eligible for FAFSA?

Can I apply for a private loan if I am not eligible to apply for FAFSA?

Yes. This would be a good scenario where a private loan can offer similar benefits of subsidized or unsubsidized loans to pay for tuition over an extended period of time if you qualify.

What are the differences between a private and government loan?

Generally, College Ave works similarly to a government loan. Since a private loan is based on the credit history of the applicant or a cosigner, eligibility amounts and interest rates will vary for each applicant. You can always find out the terms of a the loan before you accept any of their offers to help make an informative decision.

What are the requirements to apply for a private loan through College Ave®?

As the applicant, you will also need to be at least 18 years of age at the time of submitting an application. In Addition:

- Your current or future physical address in the State of California.

- Social Security or ITIN number.

- Employer and income information (if employed).

Will I be able to apply if I have poor or no credit?

Yes. As you long as you meet the application requirements, you can apply. Though eligibility is based on credit rating, you can add a sponsor or a cosigner to your application to obtain more favorable loan terms.

Can I apply for a private loan as an international student?

Yes. However, private loan lenders may request to apply for additional funding with a cosigner or a sponsor. There are differences between the two and recomend meeting with the financial aid office to learn about all the options available for international students.

How can I apply for a private loan for my field of study?

If you are eligible to apply for FAFSA, we highly recommend you meet with our Financial Aid Office FIRST before submitting a private loan application. It is also important to know the amount of funding you will need to submit your request for funding.

Step 1: Meet with the Financial Aid office to request an estimate of tuition and eligibility estimate

Step 2: If private funding is needed, you may submit an application. See our Finance Office for assistance.

If you need additional assistance with your application, please visit our campus office for more detailed information on your eligibility.

Get Started Today!

By clicking Submit, I expressly authorize National Polytechnic College to contact me regarding educational services via email, telephone or text at the email address and phone numbers provided. I understand this is not required to attend National Polytechnic College. MSG & Data rates may apply. Message frequency may vary. To unsubscribe reply STOP and to get assistance reply HELP. Find our Privacy Policy at https://npcollege.edu/privacy-policy